Login

Important Announcement: Update on Changes in U.S. Tariff Policies and Service Adjustments

On February 3, 2025, Eastern Standard Time, the U.S. Customs and Border Protection announced the imposition of additional tariffs on imported products originating from China, including Hong Kong. Regardless of the value, all covered imports will be assessed, and shipments containing such goods will no longer qualify for the “de minimis” administrative exemption from duty and other taxes as stipulated in Section 19 of the U.S. Code 1321(a)(2)(C).

For further details, please refer to the following link: https://content.govdelivery.com/bulletins/gd/USDHSCBP-3d062f4?wgt_ref=USDHSCBP_WIDGET_2

In accordance with the latest policies of the U.S. Customs and Border Protection, we are issuing the following supplemental notice regarding service adjustments. Please ensure to read carefully and make necessary preparations in advance.

Effective Date of Policy:

The above-mentioned policy will come into effect at 12:01 AM Eastern Standard Time on February 4, 2025.

Core Policy Updates:

1. Cancellation of Small Exemption Policy:

The tax-exempt clearance mode applicable to goods valued under $800 (such as T86) will no longer apply.

2. Additional Tariff Imposition:

In addition to the basic tariff rates, the following additional tariffs will be levied:

- Section 301 tariffs (applicable to specific Chinese goods)

- Sections 201 and 232 tariffs (targeting products like steel, aluminum)

- Newly added 10% tariff (applicable to all products originating from China [including Hong Kong])

Impact on Cross-Border Sellers and Recommendations:

1. Cost Increase:

Due to the recent policy changes by the U.S. Customs and Border Protection, customs and tax costs have significantly risen. The overall fulfillment costs for sellers will increase. It is advised for sellers to adjust product pricing promptly according to actual cost changes.

2. Stricter Customs Compliance Requirements:

The new policy imposes higher standards on the accuracy of product data declaration.

We recommend the following:

- Establish and enhance your own product declaration database to ensure the accuracy of information such as HS Codes and declaration elements.

- Regularly update product compliance information and stay updated on the latest requirements from the U.S. Customs and Border Protection.

3. Fluctuations in Fulfillment Time:

Due to the ongoing uncertainties in U.S. customs policy implementation, it is expected that all parcels will face delays. We advise you to make shipping arrangements in advance and communicate with customers. Prepare reminders and warnings in advance to mitigate risks.

Customer Operational Guidelines and Friendly Reminders:

1. Declaration Requirements:

Due to the strengthened supervision requirements by the U.S. Customs and Border Protection on Chinese imported goods, we kindly request you to accurately fill in the information regarding your goods, including but not limited to product name, amount, quantity, destination country HS Code, weight, etc. Please ensure the authenticity, accuracy, and completeness of the declaration information. EasyChinaWarehouse will declare to the customs based on the HS Code you provide; therefore, please ensure the accuracy of the information you provide. Please note that EasyChinaWarehouse does not have the obligation to review the goods shipped by customers.

If you fail to provide or inadequately provide the HS Code, it will be considered as authorization for EasyChinaWarehouse to provide the HS Code on your behalf. Please refer to the content published on the official website of the U.S. Customs and Border Protection for specific details.

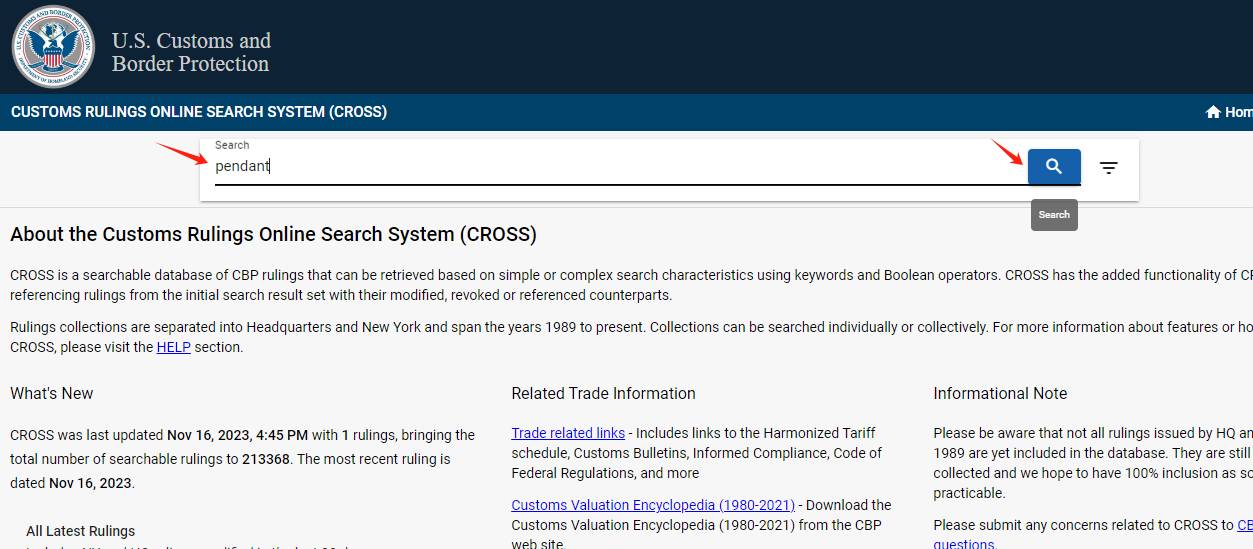

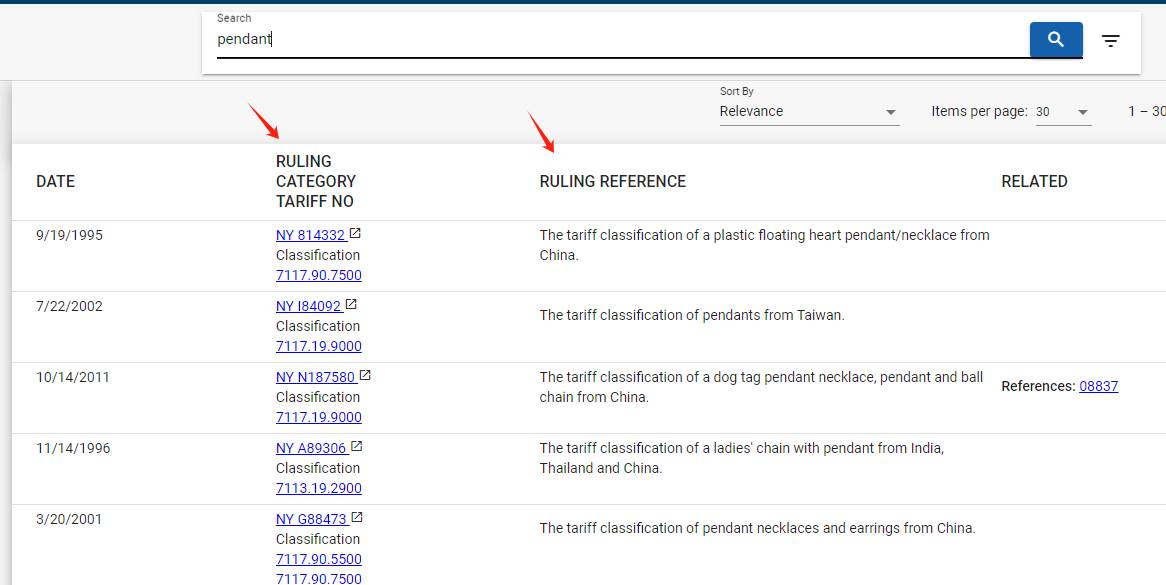

👇HS Code Query Guide👇

- Visit the U.S. HS Code lookup website: https://rulings.cbp.gov/home

- Enter the English product name you wish to search for, click search, and obtain the customs code.

2. Declaration Seriousness Statement:

If false declaration by the customer leads to consequences such as goods being detained, delayed, abandoned, confiscated, etc., the customer shall bear the consequences and compensate EasyChinaWarehouse for all losses suffered as a result.

Adjustment of Our Company’s Fees Explanation

1. Service Price Adjustment

Due to changes in the import customs clearance mode of the destination country, the customs clearance costs have significantly increased. Starting from 09:00 Beijing time on February 5th, our company will charge an additional customs clearance fee of $3.5 per consignment.

2. Advance Payment of Customs Duties

For goods shipped from China (including Hong Kong) to the United States after 09:00 Beijing time on February 5th, our company will collect a 30% advance customs duty deposit upon parcel receipt. The final settlement amount will be based on the actual amount levied by the U.S. Customs and Border Protection, following the principle of “over-refund and underpayment”.

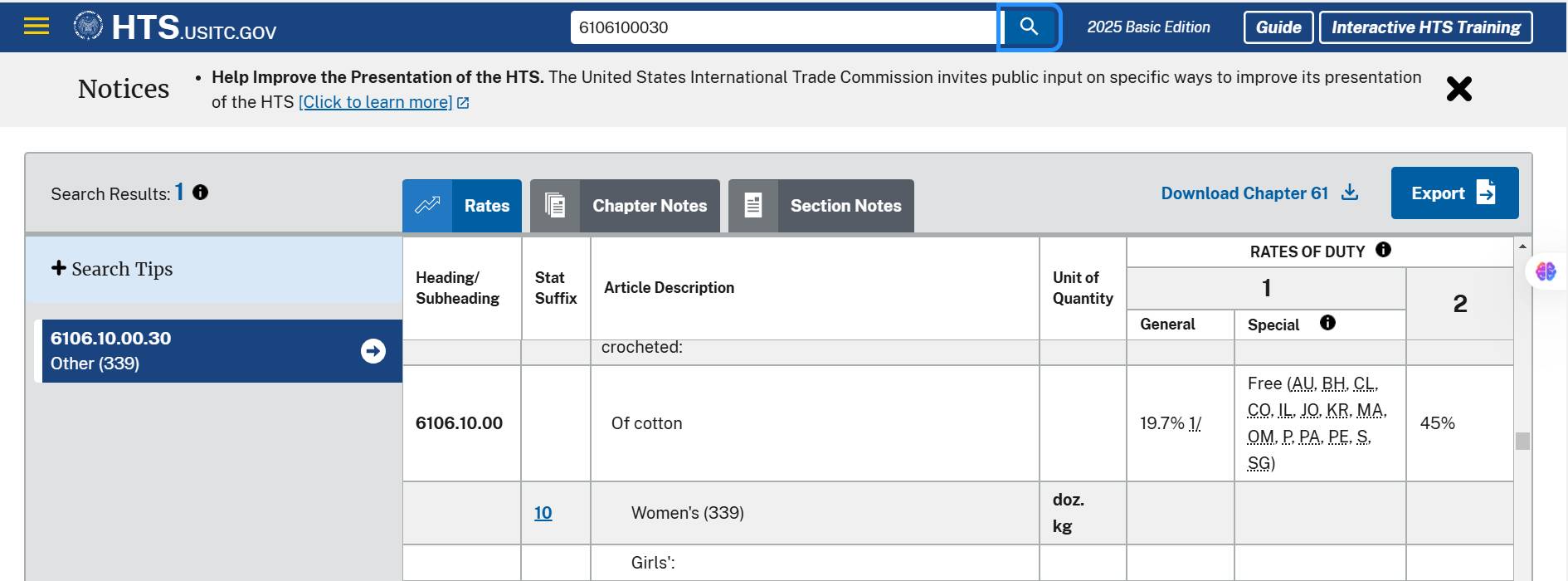

👇 Rate Query Guide 👇

Visit the U.S. tariff rate lookup website:

https://hts.usitc.gov/?query=Hand%20Held%20Massager%20%20No%20Battery%20No%20FDA

Enter the customs code to obtain the corresponding tariff rate.

For example 📢 A $60 ladies’ knitted cotton dress

Before February 4th: 600USD < 800 USD, enjoy T86 customs clearance and exemption from the $800 duty.

After February 4th: Unable to utilize the $800 duty exemption; T11 customs clearance required with duty payment.

HTS code: 6104420010

Basic duty rate: 11.5%

Additional duties: 301 clause, additional 7.5%

Additional duties: Trump’s new policy, additional 10%

MPF declaration fee: $3.5

New declaration cost: 60 * (11.5% + 7.5% + 10%) + $3.5 = $20.9

if you need any help – please feel free to ask us at easychinawarehouse.com/contact

All the best,

Justin Lin, CEO

Easy China Warehouse